Our Hsmb Advisory Llc Statements

Our Hsmb Advisory Llc Statements

Blog Article

The 6-Minute Rule for Hsmb Advisory Llc

Table of ContentsFacts About Hsmb Advisory Llc UncoveredThe smart Trick of Hsmb Advisory Llc That Nobody is Talking AboutThe Facts About Hsmb Advisory Llc RevealedRumored Buzz on Hsmb Advisory LlcExcitement About Hsmb Advisory LlcOur Hsmb Advisory Llc PDFs

Ford says to stay away from "cash money worth or irreversible" life insurance coverage, which is more of a financial investment than an insurance policy. "Those are very made complex, featured high compensations, and 9 out of 10 individuals do not require them. They're oversold since insurance agents make the biggest commissions on these," he states.

Special needs insurance policy can be costly. And for those who decide for long-lasting care insurance coverage, this plan may make impairment insurance policy unnecessary.

What Does Hsmb Advisory Llc Do?

If you have a chronic health and wellness problem, this type of insurance policy can end up being vital (Health Insurance St Petersburg, FL). Do not allow it emphasize you or your financial institution account early in lifeit's usually best to take out a plan in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later.

If you're a small-business proprietor, take into consideration shielding your resources by buying organization insurance policy. In the event of a disaster-related closure or period of restoring, company insurance can cover your revenue loss. Think about if a significant weather occasion impacted your shop or production facilityhow would certainly that affect your revenue?

Plus, using insurance could occasionally cost even more than it saves in the long run. If you get a chip in your windscreen, you may consider covering the repair expenditure with your emergency cost savings rather of your automobile insurance policy. Insurance Advisors.

Unknown Facts About Hsmb Advisory Llc

Share these ideas to protect liked ones from being both underinsured and overinsuredand speak with a trusted expert when required. (https://yoomark.com/content/httpswwwhsmbadvisorycom)

Insurance coverage that is bought by a private for single-person coverage or insurance coverage of a family. The specific pays the premium, instead of employer-based medical insurance where the employer commonly pays a share of the premium. People might go shopping for and acquisition insurance from any kind of plans readily available in the individual's geographical region.

Individuals and families might qualify for monetary help to lower the expense of insurance premiums and out-of-pocket prices, but just when signing up via Connect for Health Colorado. If you experience particular changes in your life,, you are qualified for a 60-day time period where you can register you could try these out in a private plan, also if it is beyond the yearly open enrollment period of Nov.

10 Easy Facts About Hsmb Advisory Llc Shown

- Connect for Health Colorado has a full checklist of these Qualifying Life Occasions. Reliant kids who are under age 26 are eligible to be included as relative under a moms and dad's insurance coverage.

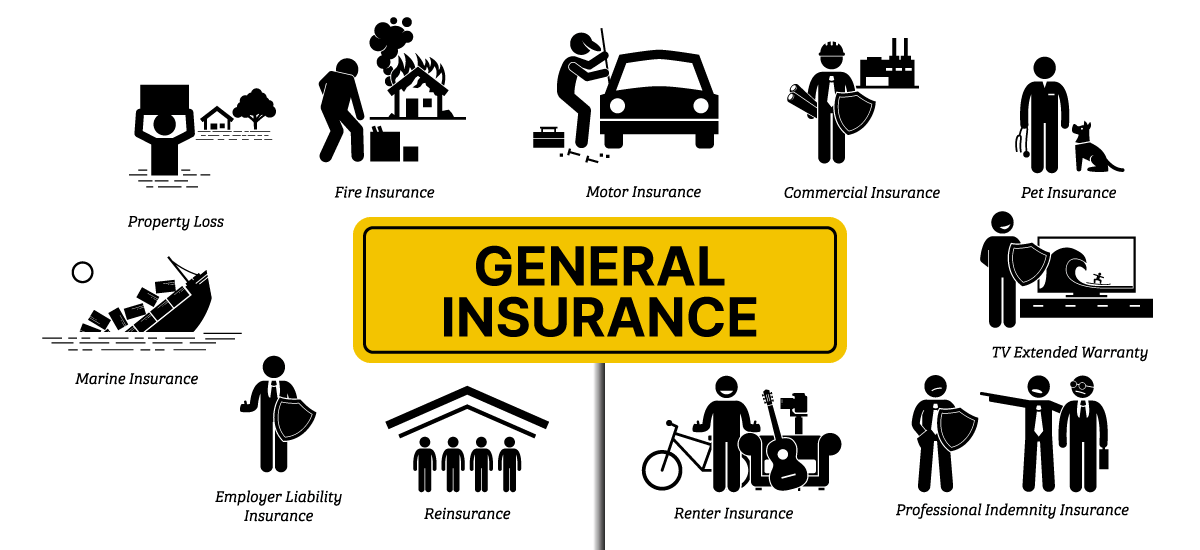

It may seem straightforward however recognizing insurance coverage types can likewise be perplexing. Much of this confusion originates from the insurance industry's ongoing objective to develop tailored protection for insurance policy holders. In designing flexible plans, there are a variety to choose fromand every one of those insurance policy types can make it challenging to understand what a certain plan is and does.The 5-Minute Rule for Hsmb Advisory Llc

The most effective place to start is to discuss the difference in between both kinds of basic life insurance policy: term life insurance and irreversible life insurance policy. Term life insurance coverage is life insurance policy that is only active temporarily period. If you pass away throughout this period, the individual or people you've called as recipients may get the money payment of the plan.

Many term life insurance plans let you convert them to an entire life insurance plan, so you do not shed coverage. Usually, term life insurance policy policy premium settlements (what you pay per month or year into your policy) are not secured in at the time of purchase, so every 5 or 10 years you possess the policy, your premiums could rise.

They additionally have a tendency to be cheaper overall than entire life, unless you acquire a whole life insurance policy policy when you're young. There are likewise a few variants on term life insurance coverage. One, called team term life insurance policy, prevails among insurance alternatives you might have accessibility to with your employer.Hsmb Advisory Llc - An Overview

This is generally done at no price to the employee, with the ability to acquire extra coverage that's taken out of the staff member's paycheck. One more variation that you may have accessibility to through your company is supplementary life insurance policy (St Petersburg, FL Life Insurance). Supplemental life insurance policy can consist of unintentional death and dismemberment (AD&D) insurance coverage, or interment insuranceadditional coverage that can help your household in case something unanticipated occurs to you.

Irreversible life insurance coverage merely refers to any life insurance policy policy that doesn't run out. There are several kinds of long-term life insurancethe most common types being whole life insurance policy and global life insurance policy. Entire life insurance policy is specifically what it seems like: life insurance policy for your whole life that pays to your beneficiaries when you pass away.

Report this page